5 Steps to take your Sinking Funds Digital

Sinking funds are the corner stone of every budget. Not only do they ensure you have money to hand for those important expenses that regularly come up, but they help you practice the discipline of planning ahead and not spending everything you earn. This article will tell you the 5 steps to take your sinking funds digital!

Some people prefer to have cash sinking funds – actually withdrawing the money and putting them into sinking fund envelopes.

But how can we replicate the process digitally?

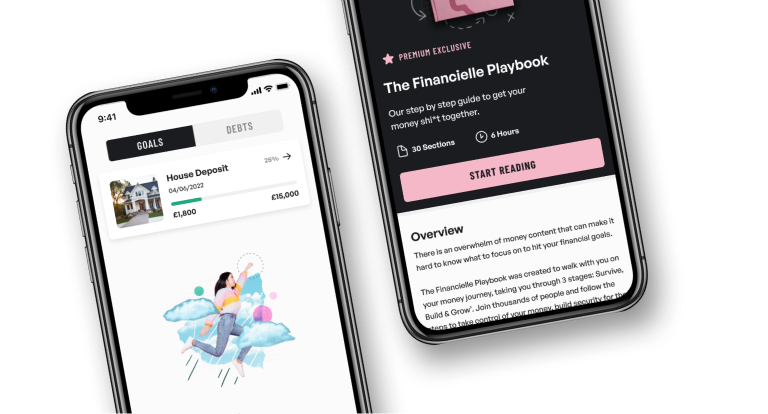

The Financielle App

First of all download The Financielle App and head to the Financielle Playbook and Budget Tracker. Here you can learn all about sinking funds and access a list of ones to include in your monthly budgeting e.g Christmas, Hair & Beauty and Holidays.

You can then use these sinking fund pots and allocate your money through a number of banking platforms.

Now we have the emergence of “challenger banks” – who have disrupted the old, traditional ways of banking and we can utilise their innovations to help us with our sinking funds. Here are 5 steps to take your sinking funds digital.

1. Open Up a Bank Account that is capable of virtual “Spaces” or “Pots”

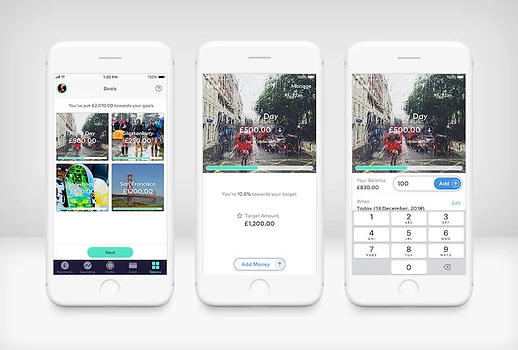

This means separate areas within the same account for you to put money. Examples of these are Starling, which has their goals facility that creates “Spaces” and Monzo which uses the concept of “Pots”. If your current banking provider doesn’t offer these kind of services, consider switching or opening another account.

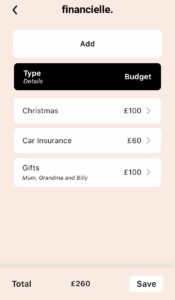

2. Decide what your annual sinking funds are for, their totals and work these into your monthly budget.

Now a rough and ready way to do this is take the annual amount for the sinking fund, for example £1200 for car insurances, divide it by 12, and incorporate this into your monthly budget, meaning that you need to put £100 a month into your car insurance space. Now you can get a little more sophisticated and adjust the monthly amount depending on when the pot is needed (for example car insurance due in 3 months and it is £1200 therefore you need to put £400 per month into it for 3 months) but the simple way still works and if in doubt, over-fund or set yourself a challenge to fill your sinking pots early with extra income from side hustles.

3. On pay day, transfer your sinking fund money

In your budget, you should have individual monthly amounts for your sinking funds plus a monthly sinking fund total (i.e. all of them added together). If you have a separate bank account for your sinking funds, then you need to transfer the total monthly sinking fund total into the separate account on the first day of your new budget.

4. You then allocate the individual monthly amounts to each sinking fund.

You do this within your banking app, for example £50 into the Gift pot, £100 into the Holiday pot, £100 into the Car Insurance pot and so on.

5. You can now track your sinking fund progress!

With the sinking funds set up, the totals set and the money transferred in, you can see your progress towards your sinking fund targets. When an expense comes up that is in your sinking fund pots, you can just withdraw the amount needed and spend – without it impacting your regular budget items.

Now Starling promote their facility for goals – we promote it for your sinking funds!

In the Financielle Playbook, we talk about how implementing sinking funds is one of the best ways you can prepare for planned expenses, spend without feeling guilty and practice discipline of putting money aside. They are also key in helping to become debt free – as it is often these one off expenses such as car insurance renewal or holiday that people often need to resort to credit cards for.

Whether you organise them in cash envelopes or digitally – they really are a great way to get organised and help support your financial wellness.