Who Wants to be an ISA Millionaire

Who Wants to be an ISA Millionaire

The ISA Millionaire Club is an exclusive club. It is estimated there are now over 1,000 individuals who have grown an ISA portfolio valued at over £1,000,000.

The current ISA annual contribution limit is £20,000 per person, which is £1,666.67 per month. If you were to max out your contributions at £20,000 per year (assuming for the moment this allowance won’t increase), it would take 50 years to hit the minimum.

So the question is, how can we shorten this timeframe?

Well firstly you want the benefit of growth and in a Cash ISA, you can earn interest at the rate set by the ISA provider. At the current date, some of the best interest rates available on Cash ISA accounts are NS&I(0.9%) Gatehouse (0.85%) Aldermore (0.6%). The interest that you earn across the time you invest is tax-free.

Now the current rates are pretty poor and they are not going to compound at a great pace with interest rates of under 1%. To get a greater growth rate, you could contribute to a Stocks and Shares ISA rather than Cash ISA, so you get the benefit of stock market growth on top of the contribution.

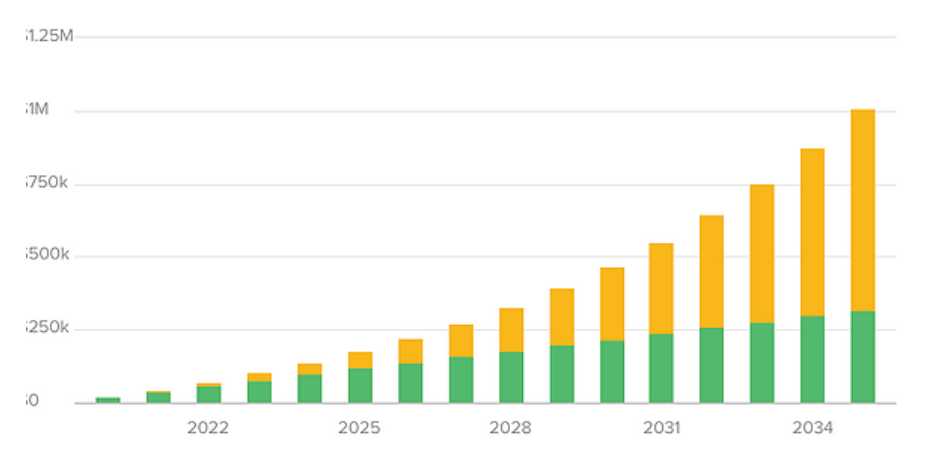

Many Stocks and Shares ISAs returned between 10-15% in terms of growth the last tax year and so delivering a much better return than the standard cash interest ISAs. If you contribute the maximum of £20,000 per year, and we estimated a 10% return on that investment, it would only take you 16 years to reach £1,000,000 (£320k of which is what you put in, the rest is compound growth!)

Now we know there are no guarantees when you invest in the stock market – the value of your investment can go up as well as down. You should also consider that pensions have the same compound growth effect and have the benefit of tax contribution from the government and if you are employed, an employer match.

There is no get rich quick to this millionaire strategy: compound interest needs time to work but when it does, it really does!

How can we help?

If you’re going to invest, we would recommend this is in the GROW stage of The Financielle Playbook (available in the premium section of our app) you are debt-free, with an emergency fund and have no intention of touching the money for a significant period of time. Even then, do your research or alternatively take financial advice from a qualified financial advisor.

So, do you fancy being an ISA millionaire?