Five tips for becoming a One Car Family

Hi, Holly here. I’m proud to announce that we are now a one car family!

Before I dive in, I want to call out that I understand I am in an extremely privileged position to be part of a family that even had one car, never mind two. This blog hopes not to trigger but to highlight that it doesn’t have to be the norm that everyone who can drive in a household needs to have a car.

I want to share our story and challenge you to consider whether it is an option for you too, using the tips below.

1. Have Goals

You should always know what financial goal you are working towards. New home? Work optional? Debt freedom? Knowing your “why” is critical to helping you navigate the many choices we have to make when it comes to spending.

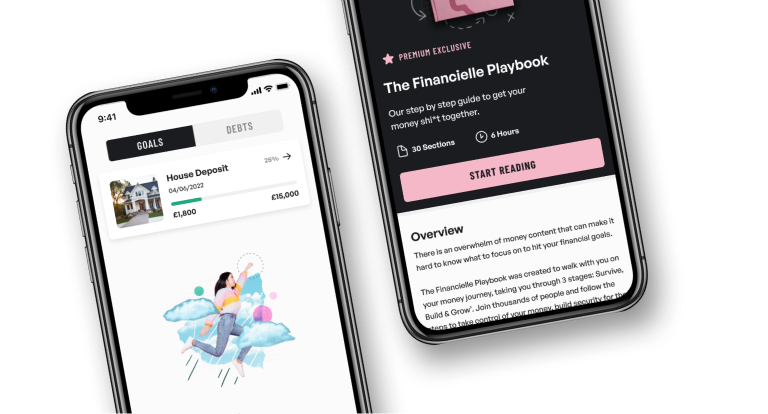

Since the day I passed my driving test when I was 17, I’ve owned a car. When I say owned, I mean leased. I would get a car on finance every 3-4 years and then give it back to start my new contract (oh the hamster wheel of car finance!). That was until I started working through The Financielle Playbook. As my husband and I worked through the plan and understood the stages Survive, Build and Grow, it gave us a fresh perspective on our finances and helped us formulate our goals.

We had some consumer debt and so we were in the Survive stage. It was at this time, working the debt snowball, I decided to finish my monthly payments and pay off the car finance in full using savings. It took me a couple of attempts until I had the nerve to transfer the remaining £7,500 over to Ford, but it freed up hundreds of pounds each month and we quickly built the emergency fund back up.

We made this decision because we had a goal to renovate our home and start to invest and develop multiple income streams – my car finance payment got in the way of those goals!

2. Identify Wants vs Needs

A key element of the financial wellness foundations in The Financielle Playbook are understanding wants vs needs and challenging you to identify which elements of your spending fall into each.

When COVID hit the UK, I was threatened with redundancy in pretty much the first week of the national lockdown. My car, like many cars, sat on the drive for the next 6 months before the country started to open up again. My mileage remained stagnant and my car maintenance and car insurance sinking funds continued to grow.

When we moved to a one-salary household earlier this year, we were forced to really look at our budget and squeeze where possible. When it came to thinking about my car, it was one of the biggest expenses we had but was returning the least in terms of value to us as a family. Now this is because I now work from home, didn’t need it for child drops offs and have family close by so access to vehicles. I recognise that we live in a village in a central location, close to all the local amenities. This is how I identified it as a want vs a need.

It’s only when working through The Financielle Playbook you are forced to look at where you spend your money and what return it will give you. We are currently in the Build stage of The Playbook, cash-flowing a house renovation. Selling the car allowed us to use the funds complete the work to the standard we want, on time, without needing any finance. Without the car, we have also saved on insurance, taxes and maintenance and so our Excess has grown, which means we will hit our goals even quicker.

3. Don’t Care What People Think

We talked about selling the car but we couldn’t imagine being a one-car family, it just isn’t the done thing. What was it that was holding us back from becoming a one car family? Perceptions? Stigma? Convenience?

It’s the same feeling as if we were to consider downgrading from a status car to an older, basic runaround – what will people think of us if we do that?

Take the time to reflect about why you have two cars. Is it because the Joneses have two BMWs on the drive that you need to as well? The Joneses are broke. You do you.

4. Plan Ahead

If you move to one car (or even no car), it is key to plan ahead and identify any potential stumbling blocks where you may need access to a vehicle. Increasing an Uber budget or looking to car-share with friends or family can help to plug the gaps of a car.

Sure, we as a family need to plan a little and communicate so that we don’t double book our social calendar or so someone isn’t left stranded – it’s definitely a work in progress!

Plan out your back-up transport options and make changes in your life that mean your less likely to need a car, such as online food shopping and more walking.

5. Model it!

One of our mantras at Financielle is “Model it!” This means taking the time to work through the numbers, explore what it would be like and test the scenario. We went for weeks at a time without using my car – helping to prove the theory that we didn’t need it.

Why not try using just one car for a week? Then a month? Get more comfortable with only needing one car – remembering that as lockdown lifts, your lifestyle may well change back whether you need a car more than you have the past year.

If you had asked me years ago would we drop down to one car, I would have said absolutely not. It’s funny how when you have your goals and then reflect on where spending gives you a return, it suddenly becomes easier to remove things from your life that didn’t drive enough value to warrant the spend vs something else.