Financial Wellness in The Workplace

Financial Wellness in The Workplace

Employers have the power to enhance financial wellness in the workplace by providing the ideal resources and support. Here’s why and how.

Employee wellbeing is an integral part of creating a healthy workplace, with a surge of initiatives in the employee engagement space, but there seems to be a missing piece.

The financial wellbeing of employees is commonly overlooked, during a period in which the cost of living is on a constant climb and growing faster than wage levels. Do employers have a role to play in this pandemic itself by starting to prioritise this forgotten wellness pillar?

What is financial wellness?

Financial wellness is subjective – your interpretation of financial wellness will be different from your friends, your family or your colleagues. Financielle defines financial wellness as being in control of money, financially stable, having security for the future and the ability to make positive life choices.

When it comes to employee benefits packages, employers often provide discounted gym memberships and free subscriptions to platforms such as Headspace and Calm. But is financial wellness missing?

With the lack of financial education provided in the current education system, by the time individuals begin taking home a salary in return for their time and skills, many are missing out on the opportunity to gain control of their future due to the lack of resources and help available. For employers who care about and value their people, giving them a chance to improve their financial wellbeing opens them up to buying their first home, creating memories with loved ones, building strong financial foundations for retirement and in turn creating a strong mindset when it comes to money.

Considering the toll that the poor financial wellbeing of employees can take on a company, it’s in the employer’s best interest to begin helping their employees to take control of their finances.

How does financial distress impact the productivity and performance of employees?

Did you know that money worries are the biggest cause of stress for UK employees? This can bring a whole host of damages to the business. According to CIPD, the professional body for HR and people development, individuals who are experiencing financial stress are more likely to be absent from work. Even for those employees attending work, many may not be performing to their usual standards due to money worries.

According to a research paper, financial incapability is associated with mental stress, anxiety and/or depression. Not only can these mental health issues cause a huge strain on the individual, but the entire company too.

Finances are a major stressor for employees

- For every £1 million an organisation spends on payroll, there is an estimated 4% loss in productivity due to poor employee financial wellbeing.

- 4.2 million worker days are lost in absences because of a lack of financial wellbeing. This is equivalent to £626 million in lost output.

- Nearly 7 in 10 UK employers believe that staff performance is negatively affected when employees are under financial pressure.

- Financial stress costs the UK economy £120.7 billion and 17.5 million hours are lost because of absence from stress due to personal finances.

It’s time to normalise talking about money in the workplace

Whether individuals live to work or work to live, a salary is given in exchange for one’s time and skills and businesses should be encouraging their employees to utilise their salaries in the best way possible, along with paying them fairly and equally. When it comes to talking about money, there is a certain stigma that puts a halt to these conversations. A CPA survey states that 47% of respondents revealed that “they would be uncomfortable talking about debt with a colleague or peer.”

By providing the correct financial education in the workplace, employers can empower their employees by allowing them to realise their financial capability. Providing these resources is vital for employees to develop and strengthen their financial preparedness for the future and present moment. Cultivating an open dialogue within the workplace allows employees to feel comfortable opening up about their personal finances, which can be a huge stress relief in itself.

How can financial wellness in the workplace be improved?

Luckily, there are ways that employers can champion financial wellness in the workplace. In the next three years, 66% of multinational organisations plan to have a financial wellbeing strategy in place.

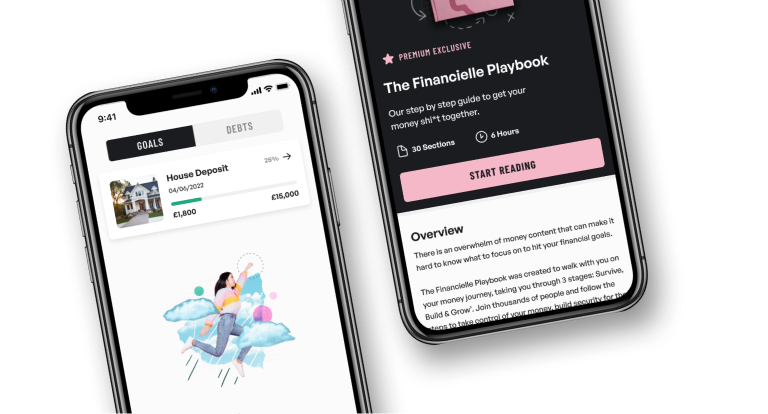

At Financielle, our app provides a simple step by step plan to help individuals take control of their money, ditch consumer debt, increase savings and invest in their future. The Financielle Playbook provides the education people need to become financially well, a host of tools including budgeting and net worth tracking, a range of content that helps provide wider context and a supportive community where individuals can feel comfortable opening up about their personal finances.

Financielle now offers its app in bulk to businesses as an employee benefit, so that businesses can support their employees to take control of their money and be financially well.

A simple solution to what can be a complex problem.