Beware of the Lifestyle Creep

As humans we’re always striving for progression. Society has primed us to always want more.

Whether it’s our car, our home, our clothes or our jobs, are we always trying to advance to the next stage? Why do we feel we must show progression, growth and success through our physical possessions?

Even though we should feel a big sense of achievement when we increase our income through a well deserved pay rise, for example, we need to be aware of the lifestyle creep.

When we earn more, there’s a danger we spend more meaning our financial wellness could be at stake. We’ve all had the day dreams: “When I earn X I’m going to get a cleaner/gardener/designer handbag/new car”. Whatever it is, we’ve found a way to spend our money before we even get it.

Here are some ways to stay financially well when you’ve had a welcome income boost:

Don’t act on your immediate instinct.

When money lands in our hands, the human instinct is often to spend it. Consumer brands spend millions trying to get us to part with our money, especially women where we control 85% of the world’s spending. There’s temptation and social pressure wherever we go. The trick is to push back against your instinct to splurge and take a balanced view.

Invest in your future

If you’ve managed to successfully increase your disposable income, it’s time to find out the ways in which you can make that money grow – specifically at a time when inflation is eating away at the value of our stagnant cash. If you’ve received a pay rise, a way in which to feel more financially well could be through your pension. You could up your contributions through your employer or your personal pension – even better you’ll receive a tax top up from the government. You can also look to invest in Stocks and Shares ISA. Work out what works for you.

Focus on wellness

Securing a bigger income can help contribute to an improvement in our lifestyle, whether that be upgrading to organic produce, investing in fitness classes, health supplements or counselling to support mental health. Investing in ourselves and how we feel can all contribute to living a happy life.

Forget the Joneses

It can be overwhelmingly tempting to keep up with The Joneses. It could be that a career move or promotion gets you moving in more affluent circles meaning you may be tempted to spend more to fit in. Remember The Joneses may be struggling to fund this lifestyle themselves, don’t bow to peer pressure. Keep your cool. Ready-made explanations for your social circle could be:

“I’m focussing on my investments right now so I won’t be out for dinner again tonight”

“I’m saving up to buy my home so won’t be coming on the weekend away”

“No, thank you.”

There’s nothing stopping you upping your socialising – just be mindful that over-committing to fit in or to please others could negatively impact your financial wellness.

Don’t squirrel it all away

We’ve focused on the concept of overspending when we receive a boost of income, but what about people that do the opposite and sit on their income scared to do anything with it? If you’ve come from a place of scarcity, securing more income can come with its added pressures. Be mindful in the current climate there could be a danger that your money loses it’s value and could go backwards when sat dormant in a savings account.

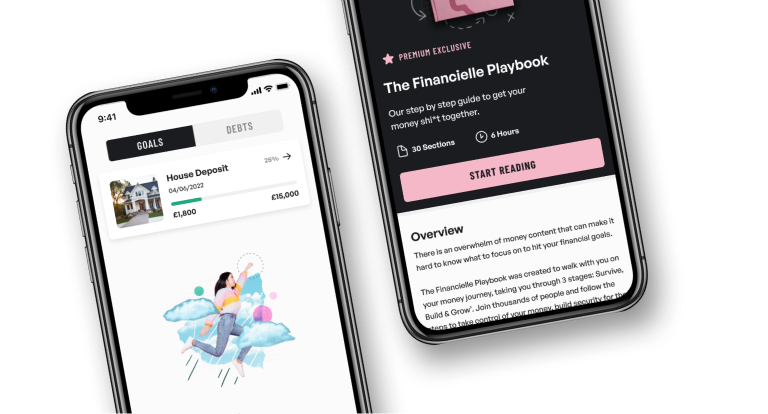

Download The Financielle app and head to our Grow area for more guidance on increasing your income.