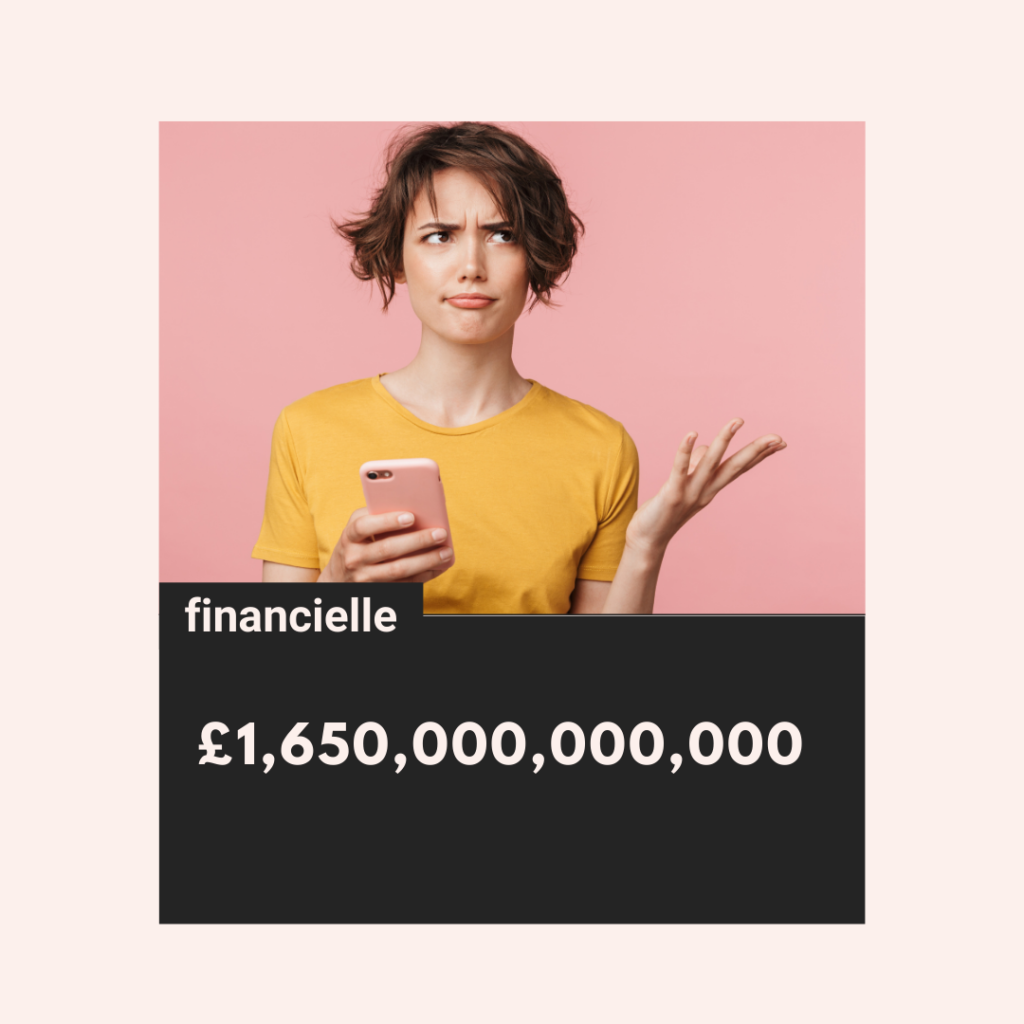

£1,650,000,000,000

You’ve probably heard of the gender pay gap, but have you ever heard of the gender investment gap?

There’s currently a £1.65 trillion investment gap in the UK alone (yes, a lot of zeros). This equates to a woman on average having £100,000 less in her pension pot compared to a man when it comes to retirement age. Oh, and women live longer on average.

This may not not ignite the fire in your belly to get your shit together because it feels so far away, but let us lift the lid on how by making actionable change now can significantly increase your financial wellness in the future.

Women are behind in all areas of personal finance; specifically pay, literacy and investments. The first two absolutely contribute to the latter – with less play and less literacy according to the Global Center for Financial Literacy in the US, it’s of no surprise that there is such a gender investment gap.

To give this problem some context we’d like you to imagine two friends and let’s say one is a boy and one is a girl. We give them both £100, kind of like in Monopoly. First, we deduct £20 off the girl because she gets paid 20% less (thank you gender pay gap), then take another £30 off her as she battles to keep up with the forever changing fashion and beauty trends set by society, where women are aggressively targeted by consumer brands to spend our money on how we look (not surprising since women account for 85% of the world’s spending). Let’s say the boys parts with £10 on consumer spending, since he’s not influenced as much in his Instagram feed.

The girl is now left with £50 vs the boys £90.

Now tell the friends they shouldn’t invest for their future. Can you see the respective journeys that have happened on the road to investing? Investing is much less risky for the boy vs the girl. The girl will approach investing with a scarcity mindset, knowing that from her remaining funds, she needs to take care of base essentials, a roof over her head, transport, food and other life essentials. The boy is likely to have much more disposable income left over after essentials to focus on investing and growing his wealth – and he’s likely to be more comfortable with risks.

So do you want to do your bit for you and start to close this investing gap between men and women?

There has been an explosion of investment content online and new investment platforms are popping up daily. The problem is there is so much work to do before jumping into investing. You need to get your shit together first.

Here’s 5 ways to get started.

1. Know Your Numbers

If you don’t know your numbers, you cannot be in control of your money. By numbers, we mean what comes in, what comes out, what you own, what you owe. You need to control your money, or it will control you. Getting your numbers down on a scrap of paper or a spreadsheet can be extremely empowering even if it’s not where you want to be. Knowledge is power.

2. Take Control Of Your Income

Benchmark your role and salary to ensure you are being paid fair and equal to your counterparts of any gender (this also applies to those who are self-employed). Could it be time to consider progression within your company or a career move? The only way you will have more residual income to invest is if you have more coming in than going out so start here.

3. Mindful Spending

This is not a frugal pep talk, you don’t need to be surviving on beans on toast and cancelling your Netflix subscription. This is also about being mindful with our money. It’s time to sit down and honestly review your spending habits, are they contributing to a feeling of wellness or not? If it’s the latter, it’s time to get your shit together and ditch the spending that doesn’t bring us joy.

4. Make A Plan

If you want to get fit you join a gym, if you want to learn a new language you take a course. The concept of money should be no different. Just saying that you are going to be better with money won’t make significant change enough for you to move to the concept of investing more quickly. We see people succeed when they have a plan to follow. What we focus on, we change.

5. Take Action

The worst thing you can do is nothing, even if these steps feel overwhelming at first. Taking the first step will help you on your financial wellness journey.

If you want to take control of your money, ditch consumer debt, increase savings and invest in your future you can work through The Financielle Playbook – The Couch To 5k for money. Available in the Financielle app now.

By Holly Holland on April 13, 2022 / Uncategorized / Leave a comment

Subscribe

Login

0 Comments

More Like This