Why You Need a Money Strategy

The start of a new month, where many of you are starting a fresh budget, with a fresh pay check, is the time to execute your money strategy. But if you are “good with money”, why do you need a strategy?

Many people let their bills go out, perhaps pick an amount to go into savings, and the rest is just what they have to spend. They then have the rest to “spend” for the month, letting their money do what it wants. At the beginning, when they are feeling flush, its the time for takeaways, online shopping, gifts. Later, when the pot goes down, its time to slow down on spending in anticipation of another pay day, and so the cycle continues.

For those that have a more focussed and purposeful money strategy, every single penny has a job to do and is budgeted, whether it be to pay for basics, pay for treats, save, pay off debt or invest. It has been allocated that job and doesn’t accidentally switch to another job.

Your strategy is your plan. You decide where you want to go (and critically, why). Then you implement the plan to get you there – whether it is becoming mortgage free, retiring early, travelling the world – it won’t happen by accident.

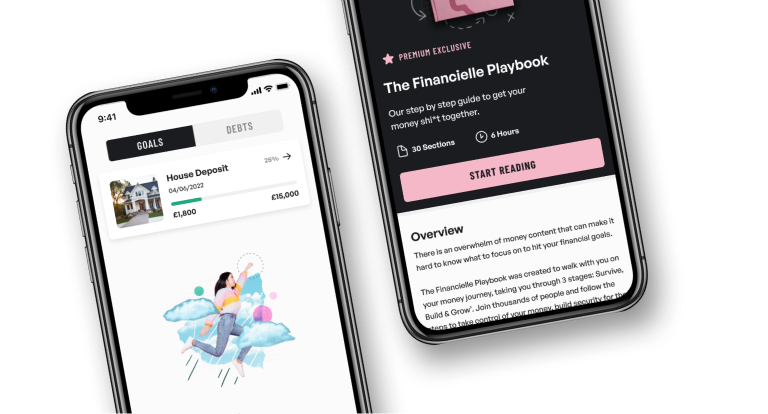

The Financielle Playbook is its own strategy to build financial wellness, building on financial foundations to get to a point where you can grow. The execution of this strategy. i.e. the actual steps that you take to make sure the plan is followed, is critical to how effective it is.

Three things you can do to effectively execute The Financielle Playbook strategy are:

1. Work to a budget, giving every penny a job to do.

2. Track progress against that budget, having full sight and control and being able to adapt and adjust as we need.

3. Automate decisions from the beginning – for example, paying bills, transferring money into sinking funds and transferring money into savings/investing automatically at the beginning of every month.

Below is a video working through how we personally execute our strategy every payday, using The Financielle Excel Budget & Goal Tracker.

Having a spreadsheet planning and tracking everything helps to give full visibility of your strategy and of your amazing progress. For example, seeing the net worth number go up as you pay down debt and save/invest reminds you why you are working hard on your money journey. There is genuine peace and financial wellness that comes from being in control of the numbers.

But above all, actually having a money strategy is the most important thing. With a strategy, you will implement the right steps to achieve your goals.