Why Women Are More Likely To Be In Debt

Why Women Are More Likely To Be In Debt

It’s no secret that debt can be crippling to our mental health. With more women struggling with debt than men, we’re going to talk about the affecting factors in this article, along with some handy tips to help you get out of debt.

Do women struggle with debt more than men?

When it comes to money, it seems that women and men have different views and needs. From a marketing perspective, women are heavily targeted; it’s been found that women account for 85% of overall consumer spending.

In a report from Starling, they concluded that women are portrayed as immature and unsophisticated when it comes to money. This has led to women being represented as financially conservative and less proactive which could discourage females to be less engaged with financial affairs.

According to research from Money Advice Service, women make up 55% of over-indebted people in the UK. Women are also 14% more likely than men to go insolvent.

Why are women more likely to be in debt?

The reason women are more likely to be in debt is mainly down to deep societal issues such as gender inequalities. From the gender pay gap to motherly commitments to financial abuse, there are too many reasons why women are more likely to be in debt. Here are just a few.

Gender pay gap

The gender pay gap is the pay disparity between men and women. In 2020, women earned 15.5% less than men and the Trade Union Congress has concluded that women are generally more likely to be in low paid work than men.

Whilst of course a lower income does not automatically put you at risk of being in debt, it could however lead to being less equipped to overcome short-term financial problems that could lead to the use of a credit card.

Women who earn less money may sometimes have no option but to take out credit or high interest, short term loans to deal with emergencies.

Motherhood

Due to what comes with motherhood, women are more likely to have gaps in their careers, not only could this lead to a delay in their career progression, it generally means taking less pay. Whilst some partners can help provide support during these periods, there are many single mothers who cannot financially afford this time off.

It’s estimated that around 90% of single parents are women and according to debt charity Step Change, the majority of their 22% of clients that are single parents, are women.

According to research from the Fawcett Society, lone mothers have been identified as the group most likely to struggle with debt. This is because they tend to have low levels of savings and are more likely to be in arrears on bills or credit repayments. The majority of single parents don’t receive child maintenance payments either, so they are lacking the support they need.

Targeted by consumerism

According to a survey by Credit Fix, women are more likely to take out credit to pay for everyday necessities such as food and clothing.

With Buy Now Pay Later (BNPL) Schemes (don’t get us started) targeting women and encouraging unnecessary spending, debt is becoming more accepted and more fashionable than ever. With Klarna alone used by over 200,000 retailers having over 10 million UK customers, this BNPL boom could not have come at a worse time. The Pandemic recession has widened the gender savings gap and is on track to remain until 2059. Marketing themselves as self-care and budgeting tools, these companies have swooped into clothing baskets and are encouraging women to take on unnecessary casual debt.

If you’d like to hear us talk about all things BNPL, check out our article “Buy Now, Pain Later.”

Financial abuse

Financial abuse is a form of domestic abuse that involves women having control of their own finances being taken away from them. Whilst anyone can be a victim of this, the UK sees 7.9% of women being victims of domestic abuse, compared to 4.2% of men.

In a study by Refuge, some behaviour patterns of abusers were revealed as:

- Making their partners stop work so they are dependent on them

- Forcing their partners to hand their wages over to them

- Taking out loans in their partners’ names

- Putting bills in their partners’ names, so if they are liable for the debt if they go unpaid

If you feel you or anyone you care about is in this situation, don’t hesitate to contact a charity for help.

Refuge

0808 2000 247

How to start ditching debt

Debt is pretty daunting. The good news is, there are many different methods you can use to pay down debt. Here are five simple steps to help you start ditching debt using the debt snowball method.

- List all of your debts smallest to largest

- Pay minimum payments on all debts

- Use the excess in your budget to smash the smallest debt

- When the smallest debt is gone, apply the minimum payment to the next debt etc.

- Work the debt snowball until you are debt-free

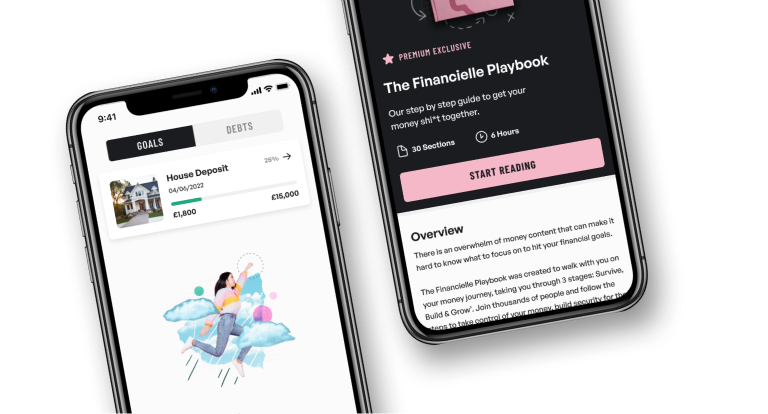

Here at Financielle, you can be part of our debt-free community (whatever stage of your journey you’re at), a place where you will find never-ending support from those who have managed to ditch debt for good.

We’ve also created a step by step guide to ditching debt and building strong financial foundations in order to become financially well. We understand that debt can take a huge toll on your mental health, that’s why we want to help you along your journey of saying goodbye to debt forever. Head to The Financielle Playbook in the Financielle App to find out more.