The Gap(s).

One of the things that the Financielle Platform aims to do is address the inherent in-balance in wealth in our community, and give everyone no matter what the income, gender or even race, a simple strategy to achieve financial wellness.

The Wealth Gap

The gap between the rich and the poor is widening; the rich get richer and the poor get poorer. Our aim is to move the median, i.e. the middle, to the right little by little and transition people from a position of poverty to a position of relative wealth for themselves and their families.

Encouraging and teaching people about financial wellness isn’t a “How to become rich” concept. It is about teaching people to be mindful when it comes to money, to take a step back and plan 5 years ahead rather than 5 days ahead, and then make your “plays” with money accordingly – hence The Financielle Playbook.

It is also about showing people the power of compounding when it works against you as well as for you. Those people in debt, including those with a mortgage, are paying a fee to the wealthy to borrow that money. The key is to work first towards a middle ground where you are not on the “customer” side of money, before transitioning to a side where you then become a “seller” of money / an asset. You become a shareholder in the huge company that pays dividends (via a simple Stocks and Shares ISA that you can open in minutes). You become a landlord, giving someone a safe and secure home whilst providing yourself an income. You switch sides.

The journey to switching sides is hard for anyone – it involves breaking past habits, possibly those handed down through generations. Learning to live on less income than comes in and to grow that gap so you can build a secure emergency fund and then raise the capital to begin investing. It is hard.

Then picture the odds being further stacked against you due to your gender. The gender pay gap has been a commercial buzz-phrase for some time, with women earning less than men for like for like roles and generally being behind for the rest of their working lives when it comes to pension values.

And then it comes to race. Systemic racism means that it is categorically hard for black individuals and consequently their families to make this switch. This week we have posted less on Instagram, joining many others posting a black square in support of the #blacklivesmatter movement and reflecting on what practical, permanent steps we need to take to be a strong, reliable ally to black british people in the United Kingdom.

In support of the #blacklivesmatter movement – it is an appropriate moment for this platform to highlight a race issue that aligns with our teachings on financial wellness: the Ethnicity Pay Gap.

The Ethnicity Pay Gap

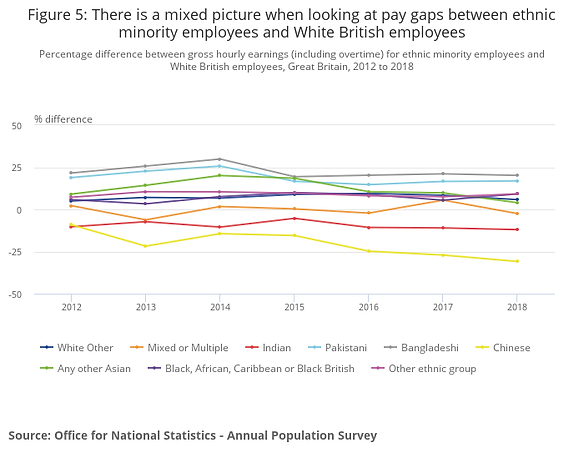

The Ethnicity Pay Gap is calculated as the difference between the average hourly earnings of White British earnings. The first ever government analysis into this was reported in 2018. The below figure shows how different ethnic groups compare with White British in average hourly pay where the 0% line represents White British. Employees in the Black African, Caribbean or Black British, Other and White Other ethnic groups on average earned 5% to 10% less than their White British counterparts between 2012 and 2018.

Those ethnicities above the 0% line earn less than White British (and note those ethnicities below the 0% line that earn more are from a much smaller population size). Just like with Gender Pay issues – employers do not measure this (the Equality and Human Rights Commission found that only 3 per cent of employers measure their disability and ethnicity pay gaps). An even greater wave of support for the tracking and monitoring of Ethnicity Pay Gaps is needed as one example of an action that can bring about change.

So what does that mean for black people working towards financial wellness?

Our black friends have a much harder hill to climb for as long as racism exists in our society. This comment was made by Al Sharpton as part of the eulogy at the memorial for George Floyd:

“Man came from a single-parent household, educated himself, rises up and becomes President of the United States and you ask him for his birth certificate, because you can’t take your knee off our neck”

This epitomises that even though a black person can work incredibly hard – they are still at a disadvantage because of the colour of their skin. We collectively have a lot of work to do to educate ourselves, our families, our communities on racism and the impact it has. There are plenty of studies, grass root organisations and resources you can go out there and find – as a minimum Google is your friend. Go learn. But here – we especially talk numbers.

The data shows even purely on earnings level that White British individuals have a head start simply on the salaries they are likely to earn, with Black British and other ethnic minorities earning less for the same work. Add to that:

- Impact of community and environment living in

- Living standards as a result of household pay

- Access to (and funding for) higher education

- Discrimination at entry to a prospective job and within a job

It is not as simple as living on less than you make and saving to invest and build wealth, when what you make is so low and the social conditions you face are so challenging. Its not as easy to get that pay rise, go for that bigger job.

It is absolutely possible and we see it everyday, but we can help accelerate this by listening, learning and sharing to reduce ignorance and improve the world we live in for everyone, but especially for black people and other ethnic minorities right now.

I would welcome direct opinion and comment on the above, especially your thoughts on disparity in earning levels, thoughts about how this can be improved and what the government and companies should be doing to tackle this element of the fight against racism. Email me at laura@financialle.co.uk.