International Women’s Day 2020 – 5 things you can do now to help advance women financially…

1. INVEST

See money as a tool for growth, rather than an enabler of consumption. This is a key factor as to why women are so far behind men financially. Women are more likely to indulge in “retail therapy” in response to a negative situation such as a tough week at work or receiving bad news, or go on a “spending spree” in response to a positive situation, like a good week at work or receiving a bonus. Once the dopamine hit of spending has gone, we are left with “stuff” – and more importantly we just gave away our tool for growing our wealth.

If we could be more balanced in setting aside money for things that make us happy AND money for investing for growth, we are going to start closing the wealth gap and more importantly, be financially in control of our lives well into the future.

2. RAISE AWARENESS

Talk about money with other women. Britons are more likely to discuss sex than money – money really is our last taboo!

It doesn’t need to be exact details, but could be strategies, thoughts, emotions, plans, percentages even. Talking about the issue, raising awareness of things like the Gender Pay Gap and the Pension Gap, asking questions about how others invest, being open about a #debtfreejourney – this all helps to stimulate positive action when it comes to finances. You never know the amazing impact you could have on a person’s life by triggering a thought about money.

3. LEAD BY EXAMPLE

Be the change you want to see in the world; you never know who is watching. Children, young impressionable adults, friends, parents even. Being focussed on your own path and your own journey and executing whatever plan you’ve set for yourself will inspire others to do the same.

You will find, when people see you doing well, being #financiallywell – they will start to ask “What’s your secret?”. Sometimes this is better than dragging a friend kicking or screaming on to a path of change.

4. SHOW VULNERABILITY

Don’t be afraid to show vulnerability – especially when it comes to finances. Forgive yourself of past money decisions – we all make mistakes, errors of judgement, miss something. We are human! Being open about a #debtfree journey, accepting that it’s okay to be confused by financial jargon, admitting when you’re finding it tough – do it!

Sometimes, we make a problem appear bigger than it is by keeping it in. Don’t hide your vulnerability – embrace it. By doing so, you normalise the problems of other women too – helping reduce cases of “imposter syndrome” and showing others its okay not to have it all figured out.

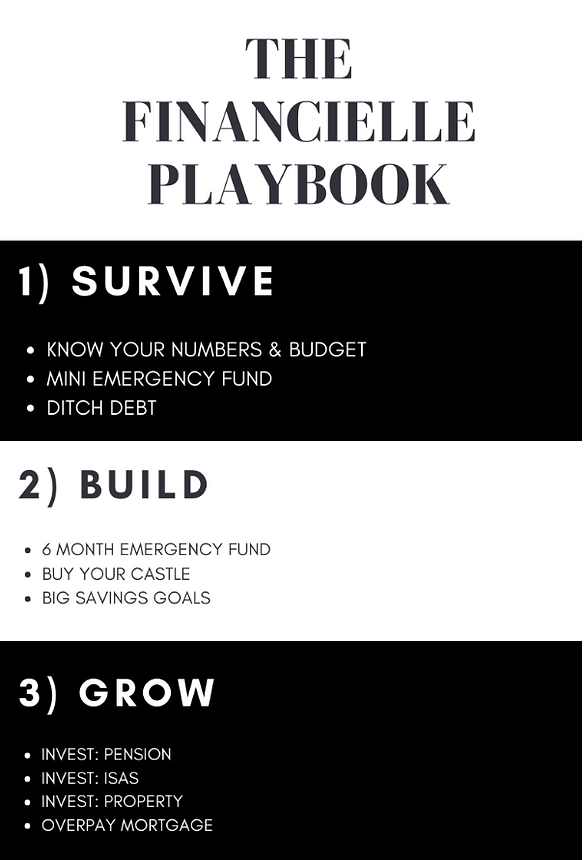

5. FOLLOW A PLAN

A plan is a wonderful way of breaking down a big journey into smaller, manageable steps. It helps to solidify your bigger “WHY” so all small steps will guide you there. A plan helps to give you focus. It then gives you confidence when speaking with other women about financial and life goals, and could inspire someone else to make their very own plan too.

The Financielle Playbook is a simple plan to achieve #financialwellness – breaking down steps one by one. Feel free to follow this one and tailor it to your life and goals, or set your own. The point is – set a plan and follow it.

Happy International Women’s Day 2020. What steps will you take to advance women before #IWD2021?