I Am Protected

For so many of us, life admin is something we put off. The bill that needs paying, the dentist checkup that needs booking in, the life insurance we still haven’t sorted.

Women especially put everyone else’s needs before their own, it’s called the mother load for a reason. Important life admin tasks such as putting in place a will and securing the right life insurance shouldn’t go to the bottom of the pile.

We need to ensure that we are properly protected.

First up, a will.

We know that 68% of adults in the UK do not have a will and even more worryingly, more than 54% of mums and dads don’t have a will, meaning there are families operating with no plan for when they suffer a loss.

Many people put off writing a will, but why? Is it that we don’t want to face our own mortality? Is there a worry of cost? Is it too difficult to discuss guardianship with family members?

Regardless of the reason, we want to ensure that everyone handles this important piece of life admin immediately. We want everyone to have their wishes and intentions clearly set out and capable of being fully understood by those we leave behind.

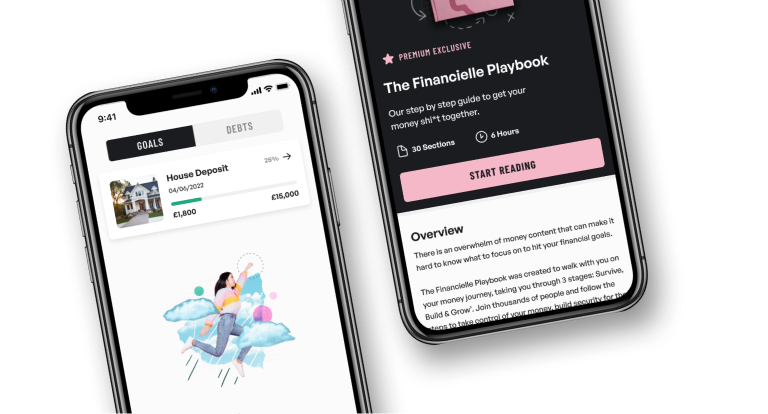

Making a will is easy and free with our friends at Bequest. You can start and complete your will in a matter of minutes and know that you’ve one less thing on your “must do” list. Access your free will here

Now that your wishes are protected, we need to look at life insurance.

Only 30% of the UK have life insurance – a worrying stat indeed. Many people start their life insurance journey because a mortgage advisor suggests it as part of the house purchase process. Whilst it is important to be correctly covered when you have an asset such as a home – often people ought to have taken out life insurance much earlier.

So why should you make sure you’re protected right now?

- Price: Life insurance is usually cheaper the younger you apply for it; you can lock in a price for a long term and spend years not worrying about financial peace of mind should the unthinkable happen.

- Women: Women are often under-covered, if covered at all when it comes to life insurance. This is because women are usually not the higher earner in the couple and so it is more common to protect a large income. If something were to happen to the female in the family, what do you think the financial cost would be to the family to cover the practical support she provided to the family? And vice versa if the lower-earner was non-female.

- Dependents: Dependents aren’t just children, they could be partners where both incomes are required for day to day living, parents, disabled relatives.

Our friends at Bequest call life insurance “love insurance”, as being protected really means to give peace of mind to those we love.

Don’t put it off to another day or leave your partner to sort it – you can have cover in place in 10 minutes and then you can tick this important job off your to do list.

Let’s be protected.