F**k off funds and why they’re important.

You may have heard of a f**k off fund before, but what does it really mean and why can it be important for our financial wellbeing?The term F**k Off Fund was initially associated with women building up cash in a secret place until they had enough to leave unhappy, unhealthy or controlling relationships. We now see it being used more widely to cover a variety of scenarios: wanting to leave a toxic workplace, getting out of horrendous house-shares or escaping from a country that is no longer bringing joy.The Financielle community has seen women build F**k Off Funds to create opportunity, freedom and choice, but how do you go about building one?

1.Know Your Numbers

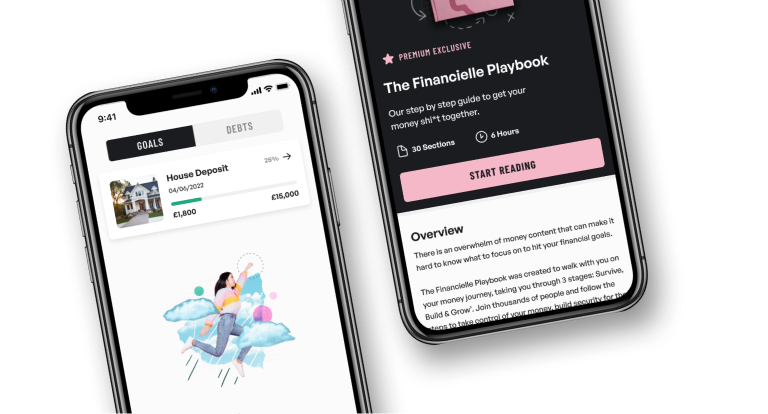

It’s important to know where you are right now, before you decide where you are going next. If you’ve always been passive when it comes to your money, it’s now time to take control. Take note of everything that’s coming in, i.e. your personal income, and going out, i.e. your share of expenses to understand where you are at with your money. You can do this in the budget area of The Financielle App.

2. Model It

What’s the magic number you need to leave your situation? Do you want to clear debt before you move on? Or do you need to instead focus on building an emergency fund and then your F**k Off Fund? If your situation is particularly desperate, work through Maslow’s Hierarchy of Needs to prioritise the absolute essentials, such as starting with a roof over your head, running water, heating and food. Your priorities are in that order.

3. Squeeze Your Budget

Once you have your F**k Off figure, it’s time to declare that your current financial goal and set a brand new budget, with a plan to hit that goal as quickly as you can.You try to do this by squeezing your budget. Examine every line of your budget to see where you can create some excess. Can you forego some nights out, beauty treatments or clothes shopping in the short term while you hit your goal? Can you look for any extra income during this time? It all contributes to getting to your goal more quickly.Once you’ve got a clear view of where you are and where you need to get to, it’s time to get your head down with laser focus and move towards your goal. You can set and track your financial goals for free in the Financielle App.

4. F**k Off

…from whatever situation you want freedom. Bye bye toxic job. See you later unhappy relationship. Your F**k Off fund gives you options, it gives you choices. Even if you actually decide not to leave the situation you’re in – having the financial ability to helps us to feel more financially well.

Here’s a few words of advice from two Financielle community members that have built F**k Off Funds:

Escaping a toxic workplace

“I’ve always been super cautious and super sensible. For as long as I can remember, I’ve put money aside in an emergency fund with no real intention of needing to use it – I have sinking funds for most regular outgoings. In the last few months I’ve realised it’s time to leave my current job which in itself it’s an emotional decision as I’ve been there a long time but ultimately it’s a toxic place to be. I think it’s time for a change in company, potentially in career and I need time and space to get my head around what’s next for me. Luckily the F**k Off Fund I’ve built gradually over many years means I can just walk out the door and not rush into something because I need a job. If I find something perfect, quickly – great. But if I don’t it’s not the end of the world. I’ve got funds to see me through, maybe do a bit of travelling, maybe re-train in something new. Without nurturing my boring emergency pot, I know I’d be stuck in a place I’ve fallen out of love with working all hours with no time or energy to find a more fulfilling path. It’s meant I’m excited rather than stressed about what my next step will be.”

Standing on my own two feet – with our without my husband.

Following a decade of working part time and not being the bread winner far from it i’ve lived with a fear mindset when it came to money burying my head in the sand. I’ve had 3 redundancy’s during that time and my confidence has been at an all time low. I’ve felt trapped in a loveless marriage due to fear of not having enough money! Cue 2021 my mindset shifted I started my own business created several revenue streams and then took a part time well paid contract role for the sole purpose of building a FU fund. I’ve nearly got a years salary saved up and I am just working on building up decent sinking pots so that should I decide i’m ready to leave my husband I can. Basically I never want to feel the way I have done following the redundancy’s when it comes to money I want options and freedom.

By Holly Holland on February 25, 2022 / Uncategorized / Leave a comment

Subscribe

Login

0 Comments

More Like This