Don’t leave money on the table

Don’t leave money on the table – In partnership with PensionBee

Who doesn’t like to get their hands on a freebie? We love discounts, referral credits, cashback and giveaways. We even love collecting points, Airmiles or even little stamps on our local coffee shop loyalty cards. So you would think more of us would realise the money we’re leaving on the table when it comes to pensions…

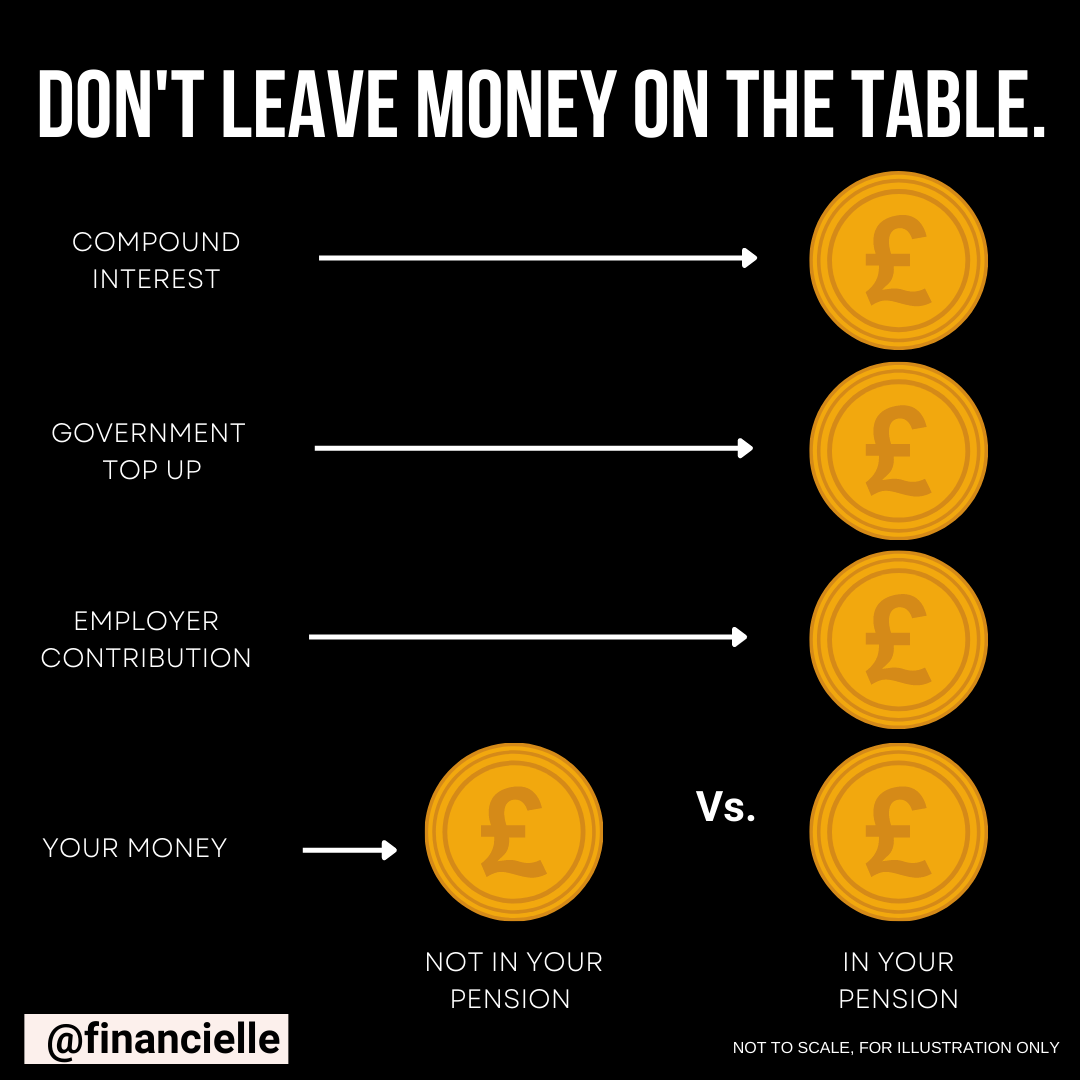

When we invest money into a pension, we get free money.

Free Money From Your Employer

Firstly if you are employed, employers legally have to offer an employer contribution to a pension where you meet qualifying criteria (i.e. you work in the UK, you are at least 22 and you earn more than £10,000 a year in that particular employment). This contribution will be at least the legal minimum of 3% of your salary, but it could be way higher depending on how generous your employer’s pension contribution policy is.

Free Money From Government

Secondly, the government top up gives us free money in the form of tax relief. For a basic rate taxpayer, this would be a 20% top up from the government and for a higher rate tax payer, you get the 20% top up plus you can claim an extra 20% through your tax return. Additional rate tax payers can claim an extra 25%.

This government contribution is available on your personal contributions whether you have a workplace pension or whether you have a personal pension – so freelancers don’t ignore the government top up!

Free Money From Growth

The third contribution, which is a little sneaky to include, is investment growth. If we opt to spend money, or save it in a savings account, we miss out on an opportunity for it to grow in the market. Whilst with investing, capital is at risk and there’s a chance investments can go down as well as up, but ultimately it is compound interest we are looking for to give us the biggest growth in our pensions and investments over the long term.

So how does this work in practice?

It depends on our personal employment and tax circumstances, but as the diagram shows, for many of us there is the opportunity to have two other sources of income into your pension, plus the opportunity for compound interest to add further growth.

Sounds like it’s a no-brainer right?

Not really no. Unfortunately we see a high proportion of women who don’t contribute to a pension at all, or they don’t contribute enough, instead contributing the default minimums, meaning they are effectively leaving free money on the table.

We’re on a mission to stop this happening.

Here’s 3 other reasons why it can be a good idea to pay into a pension:

Not relying on others to fund your retirement

Women are leaving money on the table every single day, whether that be stay at home mums, part time workers or female business owners who don’t contribute to a pension of their own. They often rely on their partner’s pension pot to see them through retirement. With the rising cost of living combined with divorce rates and the difficulty predicting health circumstances as we get older, it is wise to build some strong financial foundations of our own, independent of others. At the very least, it can mean more wealth for your collective household as you age.

Personal pensions are an asset, they form part of your legacy.

Personal pensions are an asset, meaning they belong to you as an individual completely. A pension involves a tax wrapper around what otherwise would be a normal investment account. This means wealth built up in a personal pension can be left to loved ones such as partners or children – it does not disappear with you.

The rich do it, why don’t you?

For those that move in wealthy circles, born into privilege or who have received strong financial literacy from a young age, investing into pensions and utilising tax allowances is a no-brainer. They have the view that you should keep as much of your own money as you can; being as tax efficient as possible is a priority when undertaking financial planning with an advisor. The rich don’t leave money on the table. So why would you?

Your pensions checklist:

- Make sure you are paying into a pension, whether workplace or personal, no matter what your employment status.

- If you are employed, make sure you are getting the maximum employer contribution your workplace offers.

- If you are a higher or additional rate taxpayer, make sure you are claiming any tax above the basic rate through your tax return or via HMRC directly through your tax code.

- For extra disposable income, when deciding whether to save, spend or invest in your pension, try to remember that although you’re locking money away until retirement, a decision not to is leaving money on the table.

You may want to consider opening an additional personal pension outside of your employment, for easy contributions as you go. Opening a pension with PensionBee is simple, straightforward and you can track your personal contributions and government top ups easily in the app, as well as the growth performance of your investments over time.

Click here to find out more.

Capital at risk