Budget is a Dirty Word.

Budget is now a dirty word. They are often spoken about as if they restrict and limit our ability to spend and that they keep us from doing what we want. People also connect budgets to not having enough and that they are only needed for those in difficult financial situations, who need to “make ends meet”.

We do need to remember that budgets are a necessity for those struggling financially, and the budgeting process can be quite traumatic if there isn’t enough coming in to cover what goes out. My Mum and Aunt shared a story where they remember as a family of five (four children and a single mother), my Nan used to cut a Mars bar into 5 “slices” so they could share it as a treat every few weeks – that is how little they had. My Nan did have a budget – one incorrect spending decision and the children couldn’t eat.

The reality is, even my Mum has had to warm up to the idea of a budget being a good thing, because it brings back subconscious feelings of not having enough (something she never wants her or any of our family to feel again). There are 3 main reasons that Budgets should be seen as amazing, positive tools of empowerment:

1. Visibility

Budgets give you visibility of where money flows in and out of your life. It reminds you of the income you are bringing in to the household, the expenses it takes to live your life and the amount of “personal profit” left over. With visibility comes control – you have a good vantage point to be able see what is going on.

2. Choices

When you have visibility, you have choices. You can choose where to spend your money. Where you choose to spend money indicates what is important to you. For example, you can choose to set money aside to invest for your future. You can choose to spend money on fresh food and groceries, working to improve your daily diet. You can also choose not to make a choice (the irony?) and spend randomly. Your budget reveals a lot about your choices and whether you are making the ones that reflect the life you want to lead.

3. Opportunity

With visibility and the resulting choices comes great opportunity. There is so much opportunity in your current and future budgets. Making different choices can lead to you hitting those big goals. By changing or dialing up or down spending choices, you can literally change the course of your life by grabbing opportunities.

For example, deciding to decrease wasted shopping expenditure and increase saving up for a deposit for a rental property means you are choosing to take the opportunity to become an investor. Likewise, by choosing to spend on a nice date night with your partner, or an amazing dinner out with your strategy-focused friends, you could unleash an amazing business or investment idea that would not have come to you sat at home watching Netflix resisting spending on meals out.

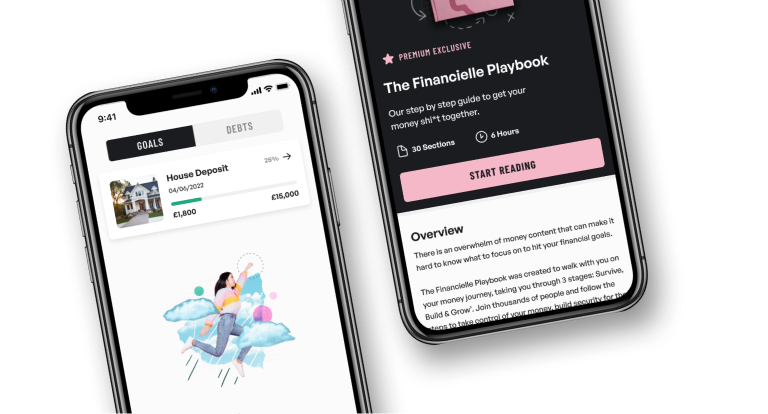

This is why when I created The Financielle Excel Budget Planner and Goal Tracker – I specifically link the monthly spending choices to big goals and tracking networth. They are not mutually exclusive.

Budgets are merely a plan for income and expenditure. You can have a monthly budget of hundreds of pounds, or millions of pounds: its the same principle. With visibility, and the right choices, the opportunities lie in your budget.

Don’t speak about budgets like they are a bad thing – I promise you, control of yours will change your life.